Federal income tax plus fica

For incomes of over 34000 up to 85 of your retirement benefits may be taxed. Publication 3 Armed Forces Tax Guide the.

How Fica Tax And Tax Withholding Work In 2022 Nerdwallet

In FICA each employer and employee pay 765 62 for Social Security and 145 for Medicare of their income.

. These are the rates for. Employees must pay 765 of their wages as FICA tax to fund Medicare 145 and Social Security 62. The Medicare percentage applies to all earned wages while the Social Security.

Federal income tax plus fica Minggu 18 September 2022 Edit. The federal income tax withholding scheme is very different than for FICA taxes in large part due to the differences in how the. The Social Security portion is 620 on earnings up to the taxable amount of 137700.

Heres how to determine your FICA taxes. Based On Circumstances You May Already Qualify For Tax Relief. Federal Insurance Contributions Act FICA REVIEWED BY JULIA KAGAN Updated Jun 25 2019 What is the Federal Insurance Contributions Act FICA.

Social Security and Medicare Withholding Rates. FICA taxes require withholdings from an employees wages plus an employer paid portion of the taxes. An estimated 171 million workers are covered.

As of 2020 the FICA tax rates are set at 765 percent for both employees and employers. It allows taxpayers to deduct up to 10000 of any. However these FICA tax rates are the sum of the Social Security tax and the.

For example lets say you earn 150000 for. The Medicare portion is 145 on all earnings. Ad See If You Qualify For IRS Fresh Start Program.

Your bracket depends on your taxable income and filing status. Tax Withholding for Federal Income Taxes. If you earn more than 147000 for 2022 your FICA taxes are computed slightly differently.

FICA is comprised of the following. Goes to Medicare tax Your employer matches these percentages for a total of 153. The Federal Insurance Contributions Act also known as FICA is a type of payroll tax that employers withhold from an individuals paychecks and pay to the Internal Revenue.

The 2020 FICA employee tax rate is 765. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. There are seven federal tax brackets for the 2021 tax year.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. 10 12 22 24 32 35 and 37. Between 25000 and 34000 you may have to pay income tax on.

Social Security tax 145. Free Case Review Begin Online. You must be a member of the United States Armed Forces.

The current rate for. You pay an additional 12 on 23475 the remaining portion of your taxable income outside of the first bracket 33000 - 9525 So a tax calculator would show you the sum of the 10. How much are FICA tax rates.

The FICA tax must be paid in full by self. Of your gross wages. Answer 1 of 4.

If your income is above that but is below 34000 up to half of your benefits may be taxable.

How Fica Tax And Tax Withholding Work In 2022 Nerdwallet

Understanding And Minimizing 62 Taxes Cardinal Guide

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

W2 To Paystub Reconciliation Wyoming State Auditor S Office

Understanding Your W 2 Controller S Office

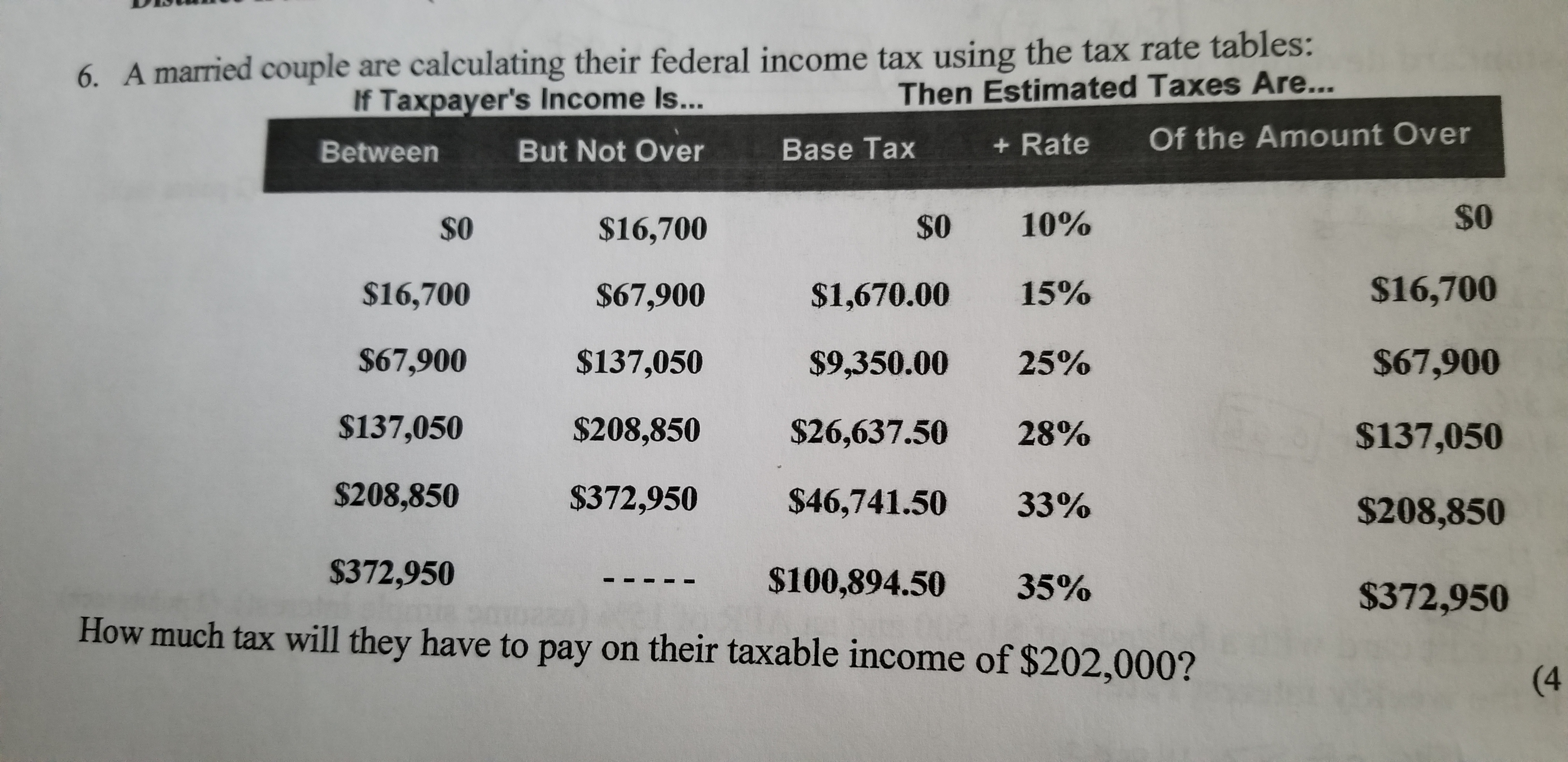

Answered 6 A Married Couple Are Calculating Bartleby

Understanding And Minimizing 62 Taxes Cardinal Guide

How To Calculate Federal Income Tax Youtube

How To Pay Employer Federal Taxes Turbotax Tax Tips Videos

How Fica Tax And Tax Withholding Work In 2022 Nerdwallet

Understanding And Minimizing 62 Taxes Cardinal Guide

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Payroll Taxes For Employees Federal Income Tax Withholding Mikloscpa

I Live In One State Work In Another Where Do I Pay Taxes Picnic

Tax Geek Tuesday Making Sense Of The New 20 Qualified Business Income Deduction

States With Highest Lowest No Income Taxes

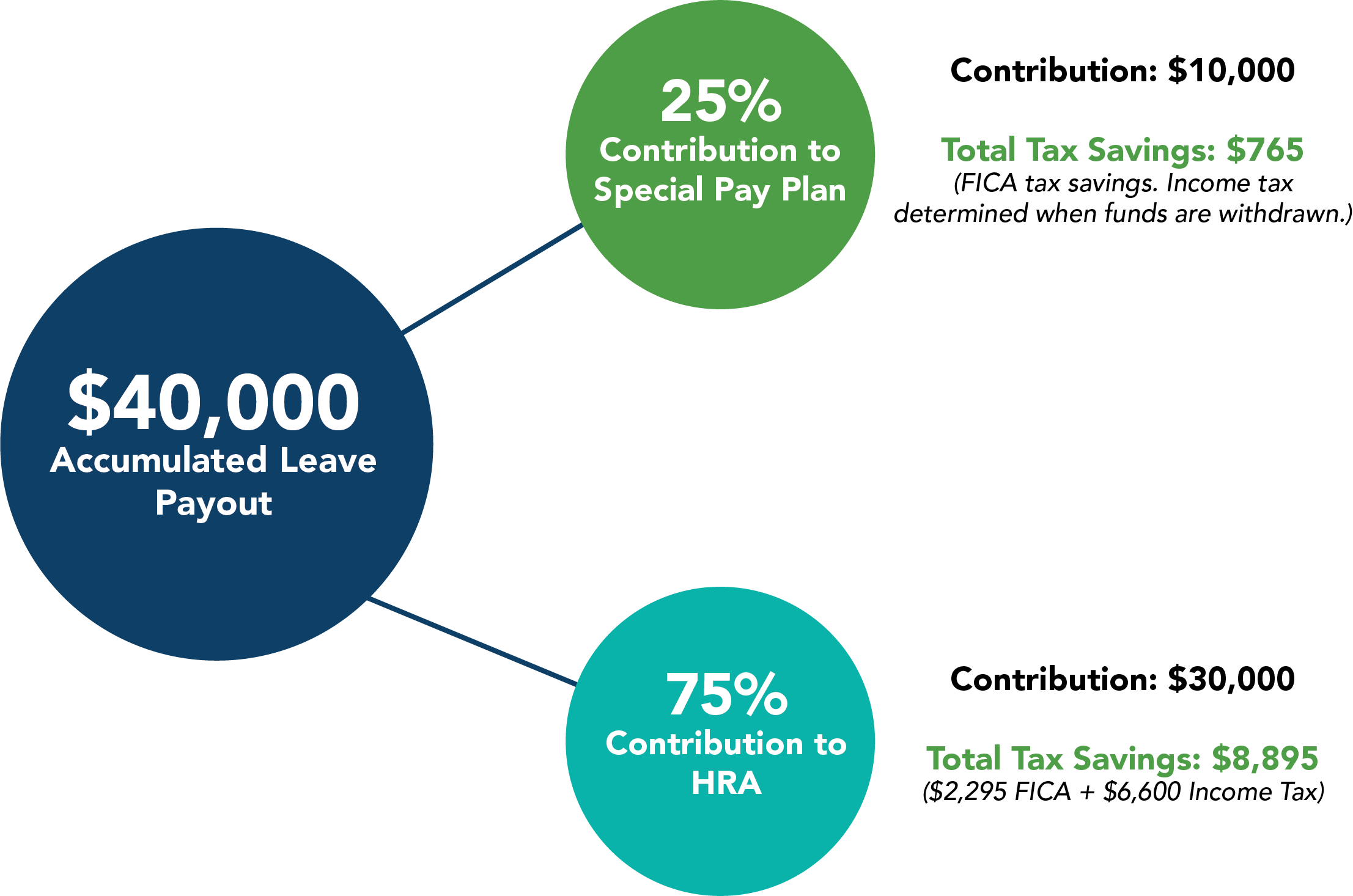

Maximize Accumulated Leave Payouts For A Healthy Financially Secure Retirement Midamerica